Increasing Prices and decreasing Inventory in South Florida

Historically and statistically, it’s considered to be an average Market when Inventory equals 6 months. Months of Inventory are calculated based on how long it would take the current Inventory to be absorbed (absorption rate), based on the current number of completed Sales, without new Inventory coming on the Market. In an average Market, the scales are tipped rather evenly in the favor of Sellers AND Buyers.

Currently, there’s 3 months Inventory of Single Family Homes in Ft. Lauderdale, throughout all of Broward County, and other areas of South Florida. Welcome to a Seller’s Market! Buyers had several years of opportunities to take advantage of a Buyer’s Market, but that’s no longer the case.

At the peak of the previous South Florida Real Estate boom, there were 3 Months of Inventory in September of 2005. At the height of the bust, when we had the lowest number of sales, there were 38.6 Months of Inventory in September of 2007. The current decrease in Inventory is because of significantly increased sales, NOT because properties were just taken off of the Market.

Multiple Offers, Bidding Wars, properties selling above their list prices, and properties going under Contract for purchase within a few days after being listed on the Market are par for the course in our current Market where demand exceeds supply.

In the Single Family Home Market in Broward County, Cash sales comprise ~40% of the total sales and in the Condo Market, Cash sales comprise ~80% of the total sales, which is one of the most significant differences between the current Market and the previous Market. During the previous Real Estate Boom 7+ years ago, the majority of property purchases were Financed, instead of being Cash purchases.

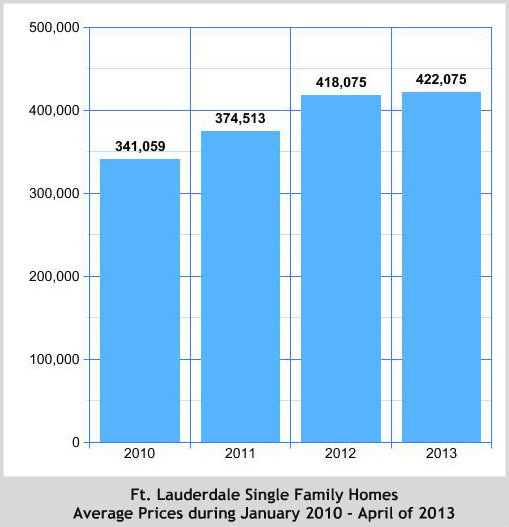

Average prices for Single Family Homes in Ft. Lauderdale have increased 24% since 2010 (see graph below) and are continuing to increase. Many Buyers who purchased a couple of years ago are already enjoying significant property value increases, while those who sat on the sidelines watching the Market missed out on great deals that were available, even though today’s prices are still much lower than they were during the height of 2005’s Real Estate boom.

Significant value appreciation and low inventory is a common theme in the Condo Market as well. Condos built during the previous Boom are sold out of Developer owned Inventory, most Buildings have much less than 10% of their Units on the Market for sale, and the majority of distressed Inventory (Foreclosures and Short Sales) have been purchased. With Condos, it’s considered to be an average/balanced Market when 10% of the total Units in a Building are on the Market for sale.

Note: Average Ft. Lauderdale Home prices depicted in the Graph below are not specific to certain areas of Ft. Lauderdale. In East Ft. Lauderdale areas, for example, average prices for Single Family Homes are $750,000 and above.

Related Information: